Main navigation

Overview of the Results

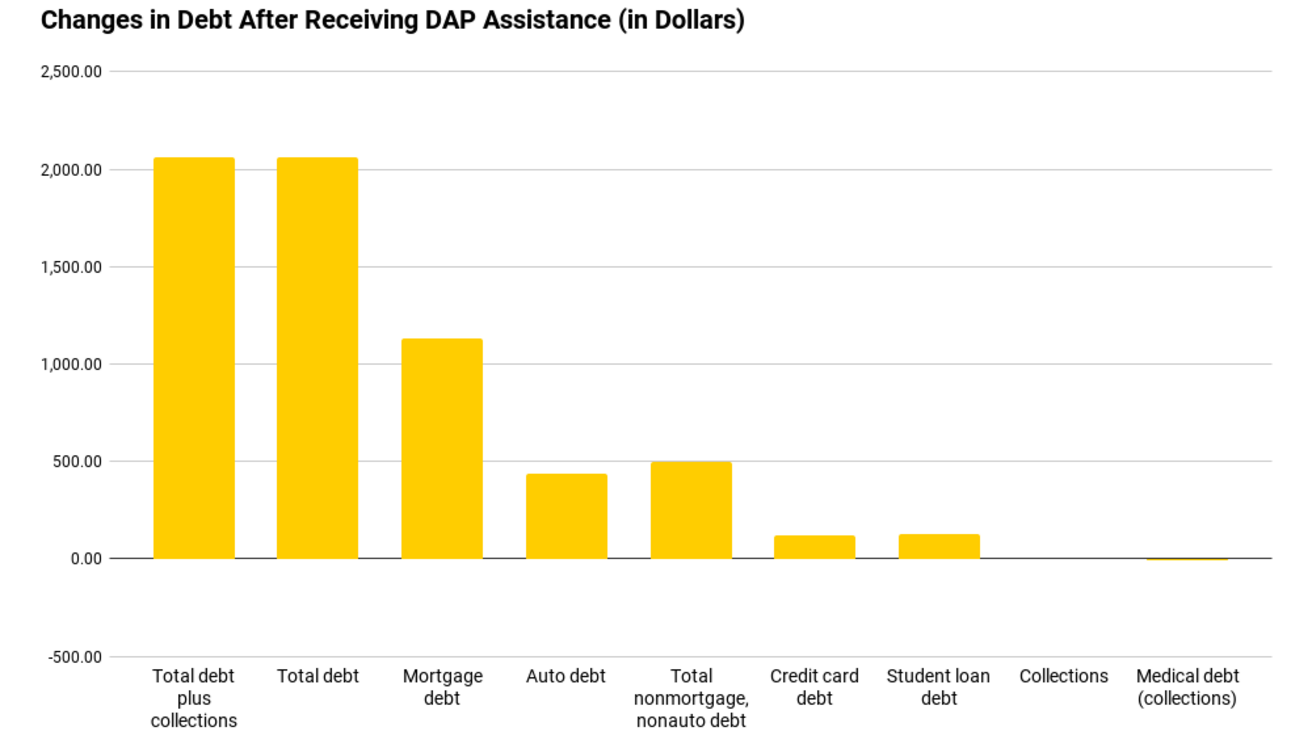

Debt increased for individuals who received the DAP assistance check in the month after cashing the check and continues to increase for the first 9 months, relative to debt amounts for other low-income individuals in Iowa. On average, total debt increased by about $2,000 with an increase in mortgage debt of about $1,100, auto debt of about $400, and other debt of about $500 (including a credit card debt increase of about $100).

Debt Paper

Coming Soon

Data Collection

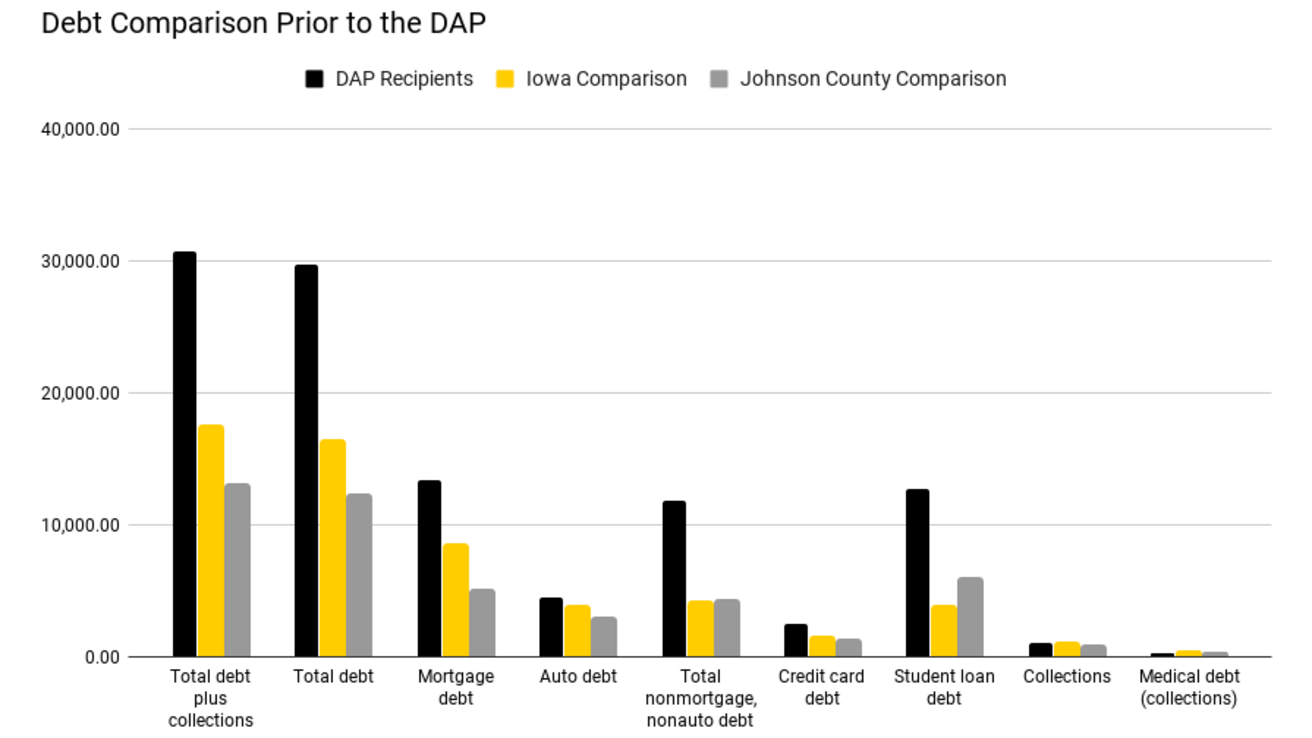

Our team gathered data from Experian’s consumer credit database to evaluate changes in debt. We utilized data from a 24-month period, from July 2021 to June 2023. Total debt is measured as the total balance on all open accounts and positively balanced closed accounts, except for derogatory accounts and collections. We used data for 1,640 DAP recipients and two comparison groups with incomes of 50,000 dollars annually or less: 3,149 Johnson County residents who did not participate in the DAP and 18,890 Iowa residents outside of Johnson County.

When did DAP recipients cash their checks?

Checks were mailed out on July 22 and August 26.

- July 27-29: 58% of checks cleared

- July 27-August 31: 91% cleared

- July 27-September 30: 99% cleared

By the end of the year, 100% of checks had cleared. But these timelines indicate an important detail: almost all of the DAP recipients cashed or deposited the assistance check within the first few weeks of receiving it.

Debt Prior to DAP Applications

As this bar graph shows, DAP recipients have higher levels of debt than both low- to middle-income comparison groups. In the eight months prior to applying for DAP assistance (dating back to September 2021) the average total debt including collections for DAP participants trended parallel to the non-Johnson County Iowa comparison group.

Changes in Debt

As the bar graph highlights, debt increased in many categories after the Direct Assistance Program, although it slightly decreased for collections and medical debt.

Trust in Government

Learn if the DAP influenced participants' opinions towards various government levels.